American Airlines Group (NASDAQ:AAL) was upgraded by investment analysts at Vetr from a "buy" rating to a "strong-buy" rating in a report released on Wednesday, MarketBeat.com reports. The firm presently has a $39.50 target price on the airline's stock. Vetr's price target points to a potential upside of 12.38% from the stock's current price.

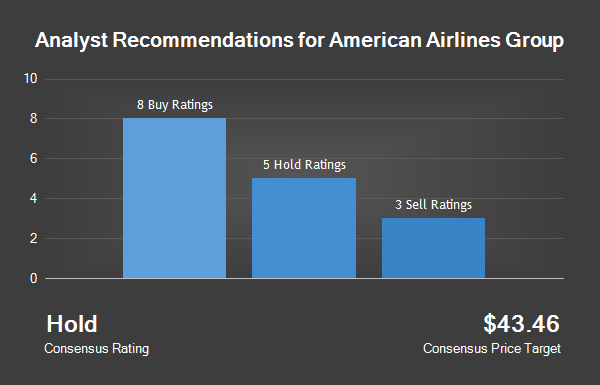

AAL has been the topic of a number of other research reports. JPMorgan Chase & Co reduced their price target on American Airlines Group from $50.50 to $41.50 and set an "overweight" rating on the stock in a report on Wednesday, July 27th. Bank of America Corp restated an "underperform" rating and set a $29.00 price target (up previously from $27.00) on shares of American Airlines Group in a report on Friday, July 15th. Imperial Capital began coverage on American Airlines Group in a report on Friday, August 26th. They set an "in-line" rating and a $40.00 price target on the stock. Morgan Stanley set a $41.00 target price on American Airlines Group and gave the stock a "buy" rating in a report on Thursday, August 18th. Finally, Raymond James Financial Inc. reiterated an "outperform" rating on shares of American Airlines Group in a report on Wednesday, June 15th. Four research analysts have rated the stock with a sell rating, six have issued a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the stock. The company currently has a consensus rating of "Hold" and an average price target of $43.44.

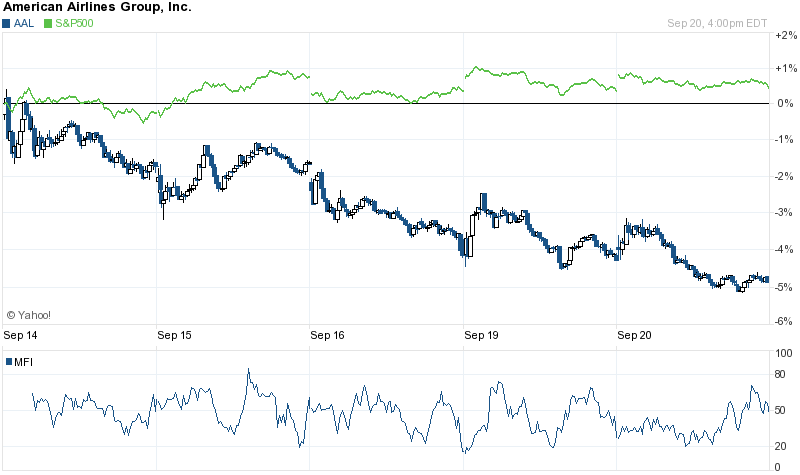

Shares of American Airlines Group (NASDAQ:AAL) opened at 35.15 on Wednesday, MarketBeat.com reports. The stock has a 50 day moving average price of $36.08 and a 200 day moving average price of $35.46. The firm has a market cap of $18.63 billion, a PE ratio of 3.32 and a beta of 0.97. American Airlines Group has a 52 week low of $24.85 and a 52 week high of $47.09.

American Airlines Group (NASDAQ:AAL) last announced its quarterly earnings results on Friday, July 22nd. The airline reported $1.77 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.68 by $0.09. American Airlines Group had a return on equity of 107.21% and a net margin of 16.50%. The company had revenue of $10.40 billion for the quarter, compared to the consensus estimate of $10.27 billion. During the same quarter in the previous year, the business earned $2.62 EPS. American Airlines Group's revenue was down 4.3% compared to the same quarter last year. Equities analysts expect that American Airlines Group will post $5.43 earnings per share for the current year.

In other news, EVP Beverly K. Goulet sold 20,000 shares of the stock in a transaction on Wednesday, July 13th. The stock was sold at an average price of $35.00, for a total transaction of $700,000.00. Following the transaction, the executive vice president now directly owns 308,604 shares of the company's stock, valued at approximately $10,801,140. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link. Also, EVP Maya Leibman sold 10,000 shares of the stock in a transaction on Wednesday, September 14th. The shares were sold at an average price of $36.34, for a total value of $363,400.00. Following the transaction, the executive vice president now directly owns 196,907 shares in the company, valued at $7,155,600.38. The disclosure for this sale can be found here. 0.64% of the stock is owned by corporate insiders.

Several institutional investors have recently added to or reduced their stakes in the stock. Primecap Management Co. CA boosted its position in American Airlines Group by 28.6% in the second quarter. Primecap Management Co. CA now owns 35,432,161 shares of the airline's stock valued at $1,003,084,000 after buying an additional 7,883,585 shares during the last quarter. FMR LLC raised its stake in American Airlines Group by 28.6% in the second quarter. FMR LLC now owns 10,098,039 shares of the airline's stock valued at $285,875,000 after buying an additional 2,243,176 shares during the period. BlackRock Fund Advisors raised its stake in American Airlines Group by 31.6% in the second quarter. BlackRock Fund Advisors now owns 9,217,078 shares of the airline's stock valued at $260,935,000 after buying an additional 2,213,277 shares during the period. Adage Capital Partners GP L.L.C. raised its stake in American Airlines Group by 146.9% in the second quarter. Adage Capital Partners GP L.L.C. now owns 6,296,233 shares of the airline's stock valued at $178,246,000 after buying an additional 3,745,807 shares during the period. Finally, Janus Capital Management LLC raised its stake in American Airlines Group by 322.1% in the second quarter. Janus Capital Management LLC now owns 3,512,651 shares of the airline's stock valued at $99,443,000 after buying an additional 2,680,375 shares during the period. 74.66% of the stock is currently owned by hedge funds and other institutional investors.

American Airlines Group Company Profile

American Airlines Group Inc (AAG) is a holding company whose primary business activity is the operation of a network air carrier through its subsidiaries, American Airlines, Inc (American) and its regional subsidiaries, Envoy Aviation Group Inc (Envoy), Piedmont Airlines, Inc (Piedmont) and PSA Airlines, Inc (PSA).